What you'll need to apply for a Low Rate Mastercard

Before you start, check that you meet the eligibility criteria and have your details and documents handy.

Step 1: Check your eligibility

- 18 years of age or older

- A resident of Australia or a temporary resident who legally has the right to work in Australia (and intends to stay) for at least the next 12 months

Step 2: Prove your identity

To apply for this account, you'll need at least one form of ID so we can verify your identity. However, if possible, please try and provide two forms of ID.

Australian Passport

Australian Driver Licence

Medicare Card

Step 3: Show proof of income

Depending on what you select as your main source of income, we'll ask for documents to show it. We're trying to understand your current situation, so always upload the most recent version of your document.

Your individual employment status will determine the documents you may need to provide us. All documents must contain your full legal name.

Step 4: Calculate your monthly expenses

When applying for a Latitude credit card, you will need to enter your share of monthly expenses. Below is a list of household and living expenses you should consider:

Household expenses- Home loan, rent or board.

- Food, holidays, recreation and entertainment e.g. regular spend on food, household, supplies, domestic/international travel, hobbies, dining out and other leisure activities.

- Insurance e.g. home and contents, life, health, vehicle, total and permanent disability, additional superannuation contributions.

- Utilities and other housing costs e.g. Electricity, gas, water, telephone, internet, streaming subscriptions.

- Education and childcare e.g. public and private school fees, childcare costs and related expenses.

- Transport e.g. public transport, registration, servicing, petrol, parking fees and road tolls.

- Clothing, personal care, health and medical e.g. clothing, personal hygiene products, gym memberships, doctor visits or medications.

- Other financial commitments e.g. credit cards, personal loans or investment property loans.

Step 5: Upload your documentation

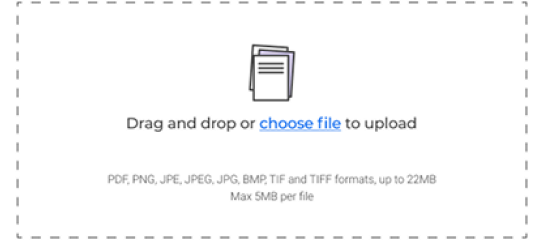

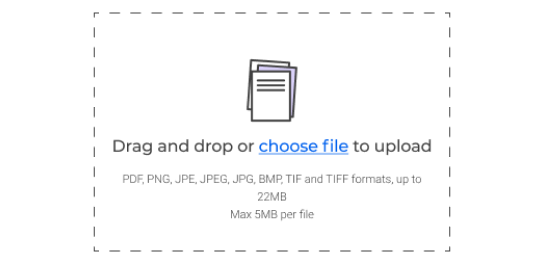

Check the maximum file size limit (e.g., 5MB per file, 22MB total upload). Make sure your documents are clear and readable.

If you are on a laptop or desktop follow these steps to upload your payslips or bank statements/other documents:

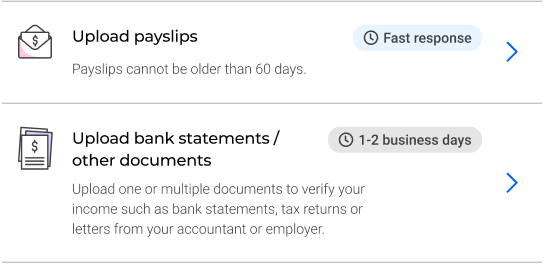

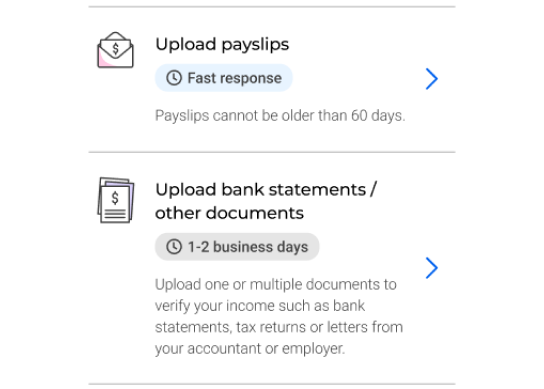

1. Under the Verify your income section, choose Upload payslips or bank statements/other documents.

2. You can:

Drag and drop files into the uploader, or

Select choose file to manually upload.

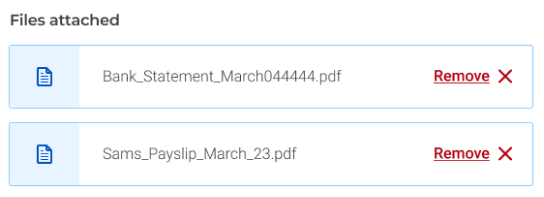

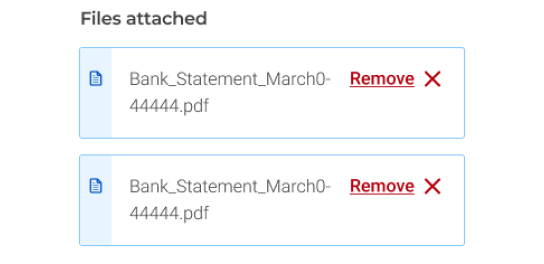

3. Your documents have been uploaded successfully and should appear in the files attached section.

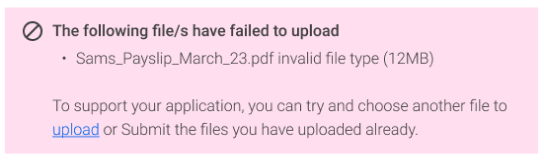

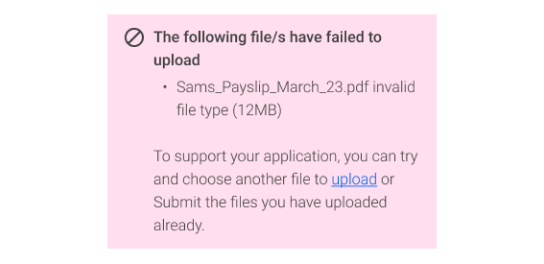

4. You have received an error. Try choosing another file or submitting the files you have uploaded already.

5. When you finish uploading your documents, click Submit. You'll see the upload progress and get confirmation once your documents are received.

Ready to apply?

If you've checked you're eligible to apply and have all your details and documents ready, let's get started.

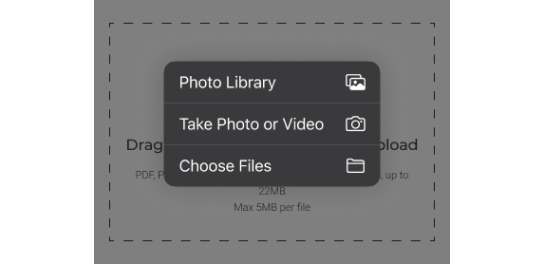

Get StartedIf you are on a mobile or tablet device follow these steps to upload your payslips or bank statements/other documents:

1. Under the Verify your income section, choose Upload payslips or bank statements/other documents.

2. Tap choose file to upload your document.

3. Your documents have been uploaded successfully and should appear in the files attached section.

4. You have received an error. Try choosing another file or submitting the files you have uploaded already.

5. When you finish uploading your documents, click Submit. You'll see the upload progress and get confirmation once your documents are received.

Ready to apply?

If you've checked you're eligible to apply and have all your details and documents ready, let's get started.

Get Started